When working as a Cert 3 Qualified Educator, your pay rate is from the Children's Services Award 2010. This Award states your minimum rate of pay based on the completion of your Cert 3 Qualification. The following will provide information for Cert 3 Education and Care Qualified Educators on minimum wages including full time and casual, job responsibilities, allowances and more.

Level 3 Classification

In the Children’s Services Award 2010, Educators with a Cert 3 qualification who are working as Assitant educators within the room will be Level 3. Each level for childcare wages gives a definition of what is expected of the employee, the qualifications required and the duties the employee should perform in order to be paid at that particular level. According to the Children's Services Award:

Level 3 - This is an employee who has completed AQF Certificate III in Children's Services or an equivalent qualification or, alternatively, this employee will possess, in the opinion of the employer, sufficient knowledge or experience to perform the duties at this level. An employee appointed at this level will also undertake the same duties and perform the same tasks as a CSE Level 2.

Indicative duties For Level 2:

- Assist in the implementation of the children's program under supervision.

- Assist in the implementation of daily care routines.

- Develop awareness of and assist in the maintenance of the health and safety of the children in care.

- Give each child individual attention and comfort as required.

- Understand and work according to the centre or service's policies and procedures.

- Demonstrate knowledge of hygienic handling of food and equipment.

Indicative duties For Level 3:

- Assist in the preparation, implementation and evaluation of developmentally appropriate programs for individual children or groups.

- Record observations of individual children or groups for program planning purposes for qualified staff.

- Under direction, work with individual children with particular needs.

- Assist in the direction of untrained staff.

- Undertake and implement the requirements of quality assurance.

- Work in accordance with food safety regulations.

As a Cert 3 Qualified Education, you are required to work in a team to provide high-quality early childhood education development, learning and care to children. Key responsibilities and duties include:

- plan and implement a quality education program

- promote the health and safety of all children

- build positive relationships with all stakeholders

- contribute to the effective management of the service

Pay Rate

For a Cert 3 Qualified Educator, your cert 3 childcare pay rate falls under the Children’s Services Award 2010. This award states the minimum amount that an employer can pay you based on your qualification and your position while working in an early learning centre.

Full Time/Part-time

Level 3.1 - (for a newly qualified cert 3 educator who begins working for the first year with their qualification).

- $28.12 per hour

- $1068.40 per week

For casual pay rate, it is $35.15

Level 3.2 (for the second year of your cert 3 qualification)

- $29.09 per hour

- $1105.30 per week

For casual pay rate, it is $36.36

Level 3.3 (for the third year of your cert 3 qualification)

- $30.00 per hour

- $1140.10 per week

For casual pay rate, it is $37.50

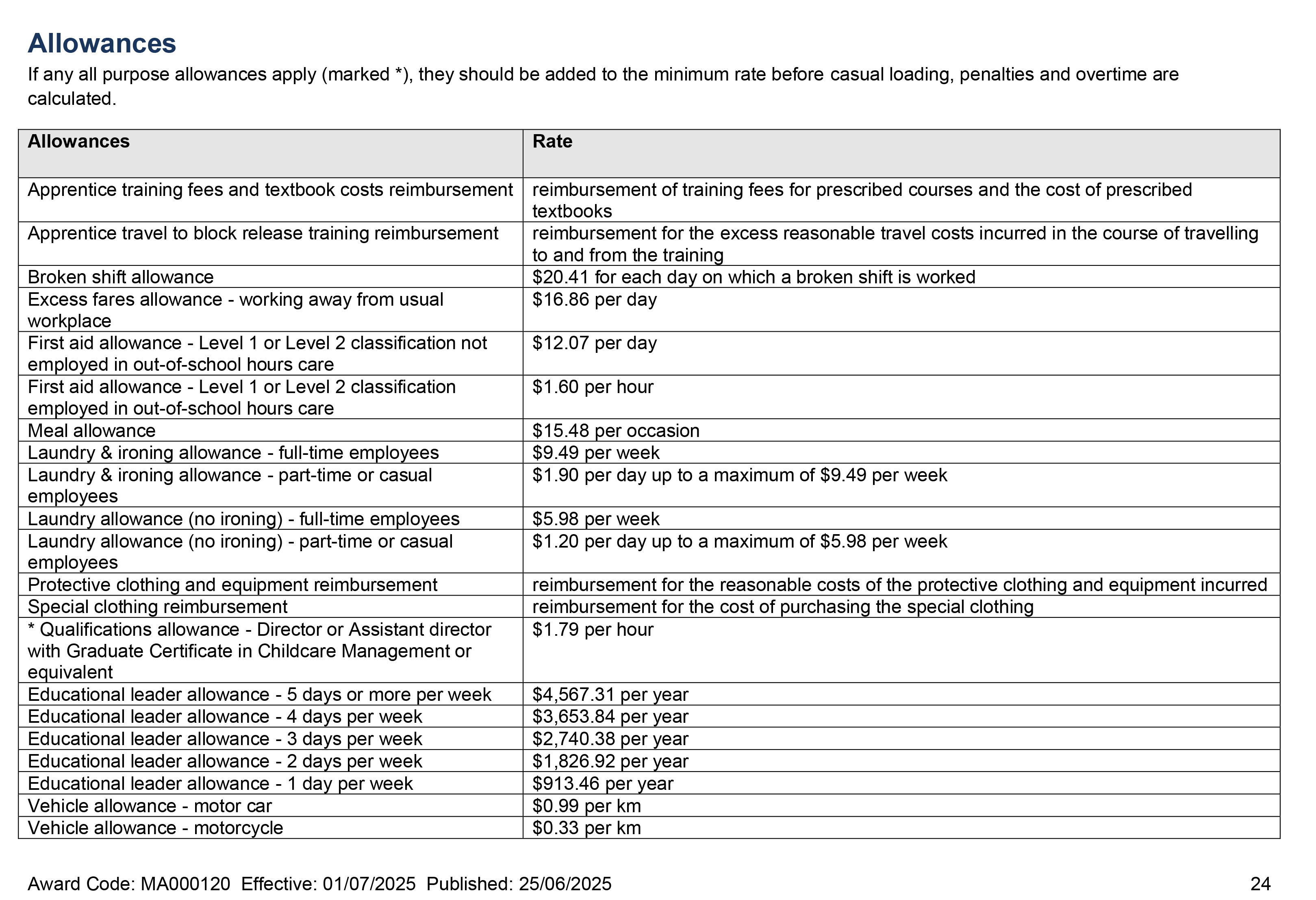

Note: These pay rates are the minimum as per the Children's Services 2010 (correct as of 01/07/25). The casual pay rate is determined by adding 25% casual loading to the full-time hourly rate.

Rest Pauses

When you're working four hours or more on any engagement, you will be entitled to a paid rest period of 10 minutes.

Provided that you're working for seven hours or more, you will be entitled to two such paid rest periods of 10 minutes each unless you agree to forego one of these rest periods.

All rest periods must be uninterrupted.

Entitlement To Overtime Rates

You are paid at overtime rates for any work performed outside of your ordinary hours of work.

Overtime will be paid at the rate of time and a half for the first two hours and double time thereafter. In calculating over time, each day’s work will stand alone.

Where, due to a genuine and pressing emergency situation, an employee is required to remain at work after their normal finishing time such time will be paid at the ordinary rate for the employee’s classification. Provided that such emergency overtime does not exceed one hour per week. For the purposes of this subclause, an emergency situation may include a natural disaster affecting a parent, another employee or the centre/service, the death of a child or parent, or a child requiring urgent hospitalisation or medical attention.

Time Off Instead Of Payment For Overtime

Your employer may agree in writing to you to take time off instead of being paid for a particular amount of overtime that has been worked by you.

Any amount of overtime that has been worked by you in a particular pay period and that is to be taken as time off instead of the employee being paid for it must be the subject of a separate agreement.

Public Holidays

When working full time and your rostered day off falls on a public holiday, you are entitled to either:

- be paid an extra day’s pay

- be provided with an alternative day off within 28 days

- receive an additional day’s annual leave

It's important to ensure you are getting the entitlements that you deserve based on your cert 3 education and care qualification. Please make sure you check your pay rates and if you have any concerns, talk to your employer about any payment issues.

As an Educator in Australia, your pay rate falls under the Children’s Services Award 2010. This award states the minimum amount that an employer can

As an Educator in Australia, your pay rate falls under the Children’s Services Award 2010. This award states the minimum amount that an employer can When working as a qualified Early Childhood Teacher (with a university degree) within a service, your rate of pay will come from the Educational Services

When working as a qualified Early Childhood Teacher (with a university degree) within a service, your rate of pay will come from the Educational Services When working as a Diploma Qualified Educator your pay rate is from the Children's Services Award 2010. This Award states your minimum rate of pay

When working as a Diploma Qualified Educator your pay rate is from the Children's Services Award 2010. This Award states your minimum rate of pay When working as a Cert 3 Qualified Educator, your pay rate is from the Children's Services Award 2010. This Award states your minimum rate of

When working as a Cert 3 Qualified Educator, your pay rate is from the Children's Services Award 2010. This Award states your minimum rate of Educational Leaders play a crucial role in their early childhood service by ensuring that the educational program aligns with best practices and supports the holistic

Educational Leaders play a crucial role in their early childhood service by ensuring that the educational program aligns with best practices and supports the holistic In early childhood education and care, ratios are more than a technicality—they are a frontline safeguard. Every child deserves responsive supervision, emotional connection, and developmental

In early childhood education and care, ratios are more than a technicality—they are a frontline safeguard. Every child deserves responsive supervision, emotional connection, and developmental Here’s a comprehensive Mobile Phone and Smart Watch Policy tailored for early childhood education and care (ECEC) services in Australia, aligned with the latest 2025

Here’s a comprehensive Mobile Phone and Smart Watch Policy tailored for early childhood education and care (ECEC) services in Australia, aligned with the latest 2025 With the new national child safety reforms kicking in on 1 September 2025, early childhood services like yours have a real opportunity to lead the

With the new national child safety reforms kicking in on 1 September 2025, early childhood services like yours have a real opportunity to lead the The Sea of Fish Challenge is a national initiative that invites children, educators, families, and communities to create and display fish artworks as a symbol

The Sea of Fish Challenge is a national initiative that invites children, educators, families, and communities to create and display fish artworks as a symbol Across the early childhood education and care sector, educators are sounding the alarm: current staffing ratios are insufficient to deliver safe, meaningful, and developmentally appropriate

Across the early childhood education and care sector, educators are sounding the alarm: current staffing ratios are insufficient to deliver safe, meaningful, and developmentally appropriate