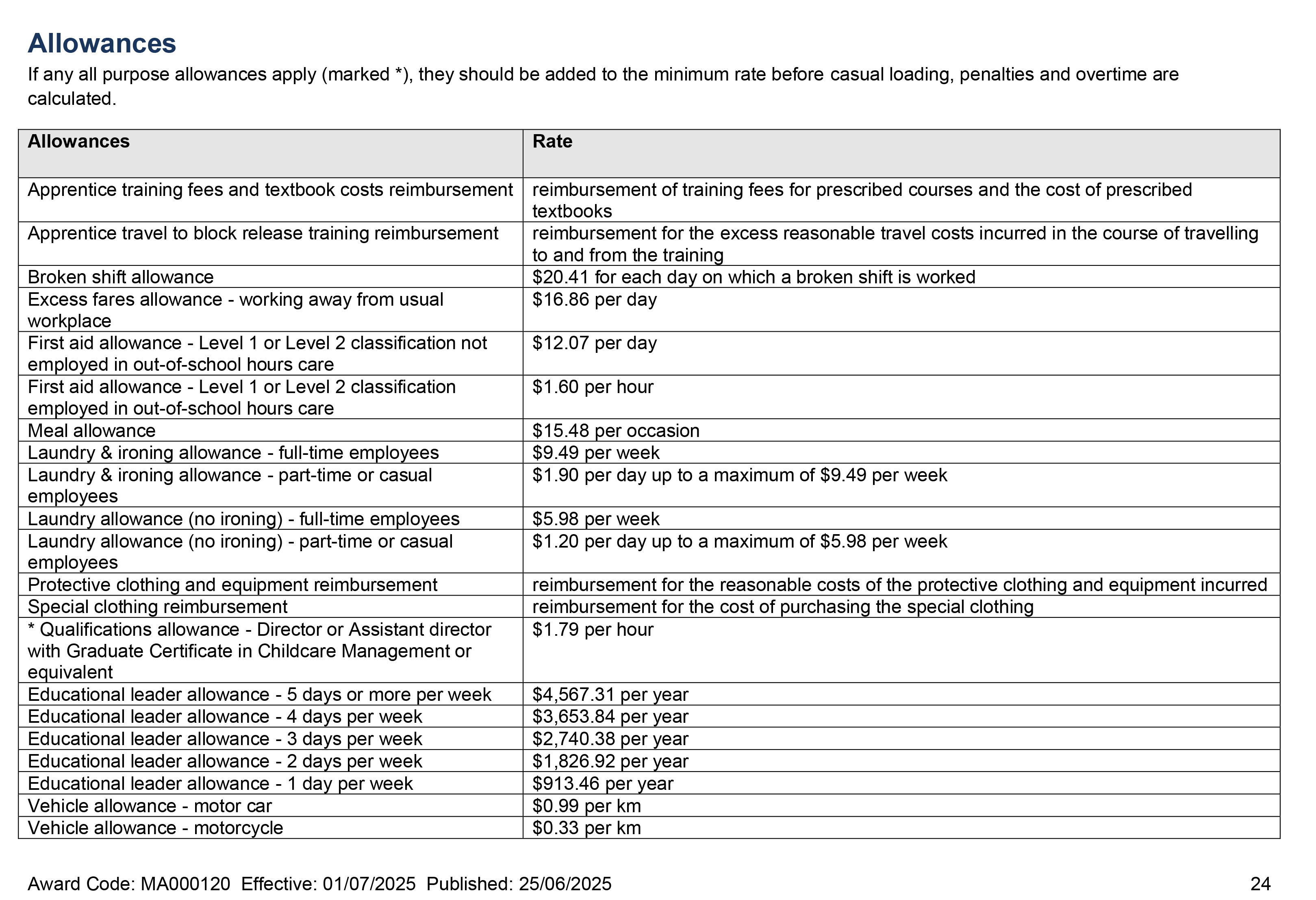

As an Educator in Australia, your pay rate falls under the Children’s Services Award 2010. This award states the minimum amount that an employer can pay you based on your qualification and your position while working in an early learning centre. This article will provide you with information on minimum wages, details of classification structure higher duties and allowances. The minimum wage table has been updated to reflect the 3.75% increase that is now in effect from 01 July 2025.

Types of Employment

When working in a childcare setting you will be either a full-time, part-time or casual employee. As per the Children’s Services Award 2010, an employee works:

- Full-time – works an average of 38 hours per week.

- Part-time – works less than 38 hours per week, has predictable hours of work and receives the equivalent conditions to those working full time.

When working part-time, a letter of agreement should be written by your employer specifying the hours you will be working each day, the days of the week required as well as the start and finishing times for the day’s work.

Casual - works for temporary and relief purposes, with a minimum of 2 hours per day.

If working as a casual employee, you must be paid the hourly rate stated for a full-time employee as per classification and minimum wage plus a casual loading.

As an employee, regarding your wages, you will be classified as a “level” which determines what your minimum wage is. You can find your level by looking at your payslip. It usually says “CSE Level ...”. Each level is different within the classification structure and is basically used to determine what your position is within the centre as well as provide you with the details on what your weekly and hourly wages are. These are only the minimum amount that an employer is expected to pay. Some may be getting paid more than it states, however, you should not be getting paid less.

Progression to the Next Level of Classification

While working at a specific level as per the classification structure you are able to progress to an upper level depending on a variety of factors such as change of position, qualification gained and the following:

- A Level 1 employee will progress to the next level after a period of one year or earlier if the employer considers the employee capable of performing the work at the next level or if the employee actually performs work at the next level.

- A Level 3 employee at this level who has completed a Diploma in Children’s Services or equivalent, and who demonstrates the application of skills and knowledge acquired beyond the competencies required for a Certificate III in the ongoing performance of their work, must be paid no less than the rate prescribed for Level 3.4.

- Competency at the existing level.

- 12 months experience at that level (or in the case of employees employed for 19 hours or less per week, 24 months) and in-service training as required; and

- Has demonstrated the ability to acquire the skills necessary for advancement to the next pay point.

Minimum Wages for Full-Time and Casual Employees

Now that you can verify which level you are at according to the classification structure, you can determine your minimum wage. The Children's Services Award only shows what the minimum wages are. So, all this tells you is your employer can’t pay you below the minimum wage that it states.

Your wages are determined by a number of different factors. Such as your qualifications, age, experience, the state you're living in, the area of the centre, your employer, your position, etc. All these factors are taken into consideration when determining your pay.

Also, each year of working with the same employer, your wages do increase, on commencement and for two years after that. So, if you stay with the same employer for a longer period of time, you’re entitled to a pay rise.

For casual employees, your hourly rate is the full-time hourly pay rate plus additional loading.

According to your classification structure and employment type, your minimum wages are (award rate from 01/07/2025):

Note:

*Reference to a year or years of service is to service in the industry

**Former Western Australian ‘E’ worker classification

***An Assistant Director who holds an Advanced Diploma (AQF 6/3 year qualified) must be paid no less than Level 5.

Casual Employment

- A casual employee is an employee engaged as such and must be paid the hourly rate payable for a full-time employee for the relevant classification plus a casual loading of 25%.

- A casual employee is one engaged for temporary and relief purposes.

- A casual employee will be paid a minimum of two hours pay for each engagement.

- A casual employee may, by mutual agreement, be paid weekly or at the termination of each engagement.

Levels For Childcare Wages

All educators fall under a classification structure; this determines your minimum wage. Each “level” gives a definition of what is expected of the employee, the qualifications required, and the duties the employee should perform in order to be paid at that particular level.

The following lists the classification of each level so you can determine your correct wage: Levels For Childcare Wages

Higher Duties

There may be times when you may be asked to perform higher duties. This basically means performing duties that are not within your job description or those stated within the level you fall under in the classification structure, the duties of an employee will be determined by reference to this award and the employee’s job description.

If you’re engaged in higher duties for two or more consecutive hours, you will be paid for the time you spent at a higher rate, provided that:

- the greater part of the time so worked is spent in performing duties carrying the higher rate.

- if you’re engaged as a Children’s Services Employee Level 5 (Assistant Director) who is required to undertake the duties of a Director by reason of the Director’s absence, you will not be entitled to payment under this clause unless the Director’s absence exceeds two complete consecutive working days.

- if you’re engaged as a Children’s Services Employee Level 3 who is required to undertake duties of the Director by reason of the Director’s non-attendance outside of core hours, you will not be entitled to payment under this clause.

- where you are appointed to act as the Director of a Centre or a Supervising Officer pursuant to the relevant childcare regulations, they will be paid for the entire period at the rate applicable for a Director or Supervising Officer; or

- If you are required to undertake the duties of another employee by reason of the latter employee’s absence for the purpose of attending (with pay) an approved training course (including in-service training), you will not be entitled to payment under this clause.

Please remember that the above wages are to be used as a general guideline only and are subject to change. The above rates are correct as of 01 July 2025.

Further Reading

How To Negotiate Your Wages - The following article lists strategies on how to talk to your employer about pay, including knowing your worth, being prepared, using open-ended questions and more.

Levels For Childcare Wages In Australia Posters - Each Poster defines the level, qualifications required and the duties an Educator should perform to be paid at that particular level. This will help Educators to understand their correct level and their correct pay at that specific level. These Posters should be displayed in the Staff Room or added to the Orientation Pack for Educators so they understand their classification level.

As an Educator in Australia, your pay rate falls under the Children’s Services Award 2010. This award states the minimum amount that an employer can

As an Educator in Australia, your pay rate falls under the Children’s Services Award 2010. This award states the minimum amount that an employer can When working as a qualified Early Childhood Teacher (with a university degree) within a service, your rate of pay will come from the Educational Services

When working as a qualified Early Childhood Teacher (with a university degree) within a service, your rate of pay will come from the Educational Services When working as a Diploma Qualified Educator your pay rate is from the Children's Services Award 2010. This Award states your minimum rate of pay

When working as a Diploma Qualified Educator your pay rate is from the Children's Services Award 2010. This Award states your minimum rate of pay When working as a Cert 3 Qualified Educator, your pay rate is from the Children's Services Award 2010. This Award states your minimum rate of

When working as a Cert 3 Qualified Educator, your pay rate is from the Children's Services Award 2010. This Award states your minimum rate of On 26 January we celebrate Australia Day. A day to reflect on what we have achieved and what we can be proud of in our

On 26 January we celebrate Australia Day. A day to reflect on what we have achieved and what we can be proud of in our Educational Leaders play a crucial role in their early childhood service by ensuring that the educational program aligns with best practices and supports the holistic

Educational Leaders play a crucial role in their early childhood service by ensuring that the educational program aligns with best practices and supports the holistic Including Aboriginal and Torres Strait Islander (ATSI) perspectives in the learning environment is essential for fostering cultural respect, understanding, and inclusivity. The following article provides

Including Aboriginal and Torres Strait Islander (ATSI) perspectives in the learning environment is essential for fostering cultural respect, understanding, and inclusivity. The following article provides The following article lists 30 art and craft descriptions and links to the EYLF. These can be used as a blurb, during observations, used for

The following article lists 30 art and craft descriptions and links to the EYLF. These can be used as a blurb, during observations, used for Nature programs in early childhood settings are a fantastic way to connect children with the natural world and promote holistic development. The following article provides

Nature programs in early childhood settings are a fantastic way to connect children with the natural world and promote holistic development. The following article provides Writing a personal philosophy for early childhood educators is a meaningful way to articulate your values, beliefs, and approaches to teaching young children. The following

Writing a personal philosophy for early childhood educators is a meaningful way to articulate your values, beliefs, and approaches to teaching young children. The following